Automating the way claims and underwriting data is collected and analyzed.

A Customizable API-Based Platform

AI Inspection, a Field Pros Direct company, is a customizable API-based platform designed to monitor Insurance Carrier’s and MGA’s select claims data and automate the data collection process from underwriting to inspection to audits.

How it works

-

01. Customize

Based on your policy or claims data, the AI Team works with you to define what data to watch, preferred triggers and frequency of triggers.

-

02. Trigger

AI monitors your policy or claims system to look for data changes to trigger your customized automations.

-

03. Collect

AI sends a survey to your insured or claimant for their feedback as well as AI can begin gathering other data using 3rd party API’s (such as Yelp, Google, D&B, etc.).

-

04. Analyze

All of the data is then collected by AI which is then automatically compared to the data in your policy and/or claims system.

-

05. Notify

Reports are automatically generated, discrepancies are identified and notices are sent to your team

Functionality and Features

Seamless integration with the policy & claim management system

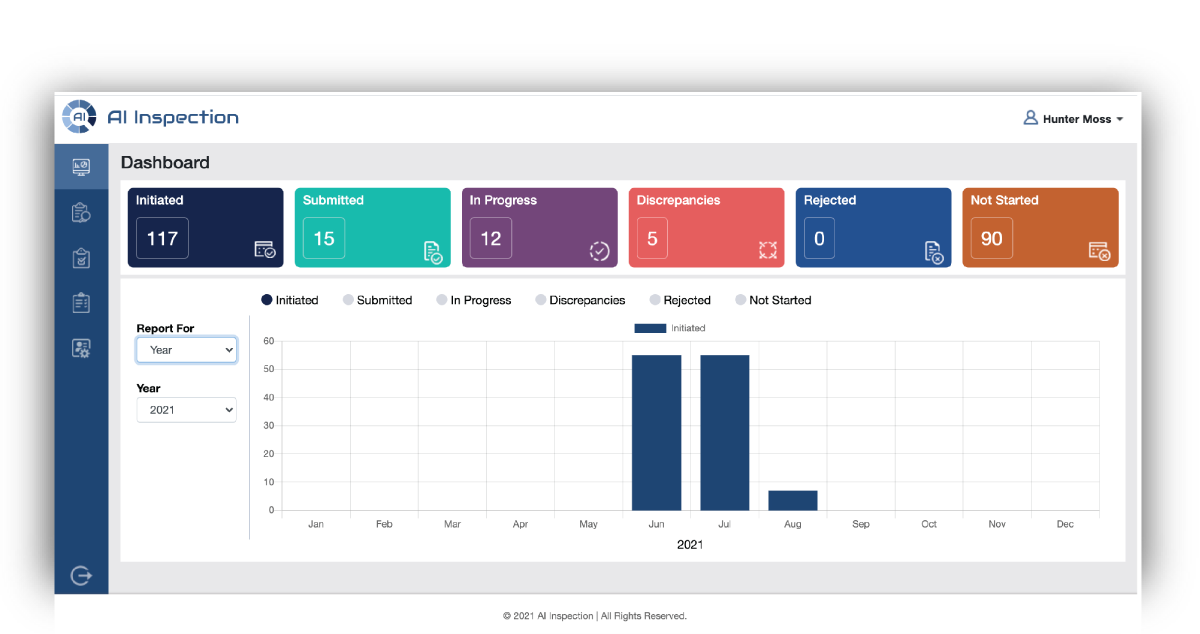

Effective Corporate Management Dashboard to track the status of all policy or claims information

Automatic notifications, follow-up attempts, and data discrepancy identification

Allows policyholder complete flexibility to respond 24/7

Unlimited number of policy or claims “triggers” and reporting data elements

Supports pictures and document uploads

Encrypted personalized link for every insured

Connect with limitless data tools to analyze policy or accident details (Google Maps, Weather, Yelp, D&B, etc.)

Let us automate your data!

Our automated platform can work with any line of business within the underwriting and claims space. We service insurance carriers, managing general agents (MGA’s) who are interested in: Faster Data Collection, Improving Claim Closure Rate, Reducing ALE or Self-Service Data Collection for Insureds.

Faster Data Collection

Improving Claim Closure Rate

Reducing ALE

Self-Service Data Collection for Insureds